Hello…with markets muddling along and Canada not doing so well, I wanted to help investors by providing some good articles and interviews and some things I have learned in my 40 years in this business.

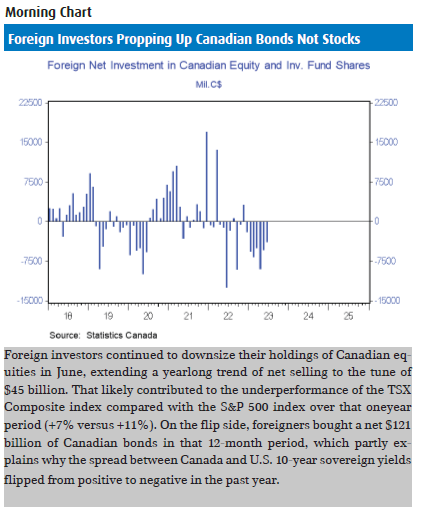

David Rosenberg explains the weak fundamentals we have. In the chart after, BMO shows foreigners have been selling our equities, so it is tough to get our overall market going. I will remind readers that foreigners tend to get their timing wrong.

Two stories to share:

1) During a very weak time in the market in the 1980’s, Canada’s largest house had two traders (I think in Geneva) in charge of selling everything for their European accounts. The accounts were going to zero weight and one trader oversaw companies that started with the letters A to M and the other N to Z. They sold at the bottom.

2) During the tough real estate markets in the Northeast US in the 90’s, the biggest mutual fund company in Boston thought problems would drift to Canada, so they sold all their Canadian Banks right at the bottom of the market.

A BNN interview got a lot of attention, and you just wonder if we are in the biggest bubble of all time.

The brilliant team from Goehring and Rozencwajg produced a new commodity report and if you have the time, it is worth the read.

Helima Croft (on the commodity markets) and Dr. Pippa Malmgren (on geopolitical issues) were on podcasts this week and they are two of the best. Pippa’s comments on the US election in the last 10 minutes are fascinating.

Doomberg’s new piece looks at Carbon Capture and they wonder (like others) if the sector will get the same treatment as nuclear energy.

Patrick Bet-David explains why cable TV is staying alive and when you understand this aspect, you will have a clearer understanding how the media and business world works.

Finally, David Brooks explains what really makes you happy and I think it is one of those articles to share with your kids and grandkids.

Have a great weekend!

David and Amy

Number 3 - Largest housing bubble of all time?

The Canadian housing market is at high risk of unravelling, according to one expert. The level of debt that Canadians have taken on in comparison to their incomes has put many in a precarious position should mortgage rates continue to rise — which is likely, Phillip Colmar, partner at Global Strategist at MRB Partners, told BNN Bloomberg in an interview on Tuesday, “Canada is probably sitting on the largest housing bubble of all time”.

https://twitter.com/geoeconomic10/status/1694020158648463705

Number 4 - Smarter Markets - Helima Croft

http://www.smartermarketspod.com/summer-playlist-2023-episode-5-helima-croft/

Helima Croft, Managing Director & Global Head of Commodity Strategy, RBC Capital Markets,“I think we should be putting ourselves in the place of these leaders of oil-producing nations and thinking about how they’re seeing the world.”

Number 6 - Goehring and Rozencwajg - Q2 Investor Letter and Market Commentary

A good 25 page read for you over the weekend. Definitely worth the download. A few noteworthy items to highlight.

Number 7 - Macro Voices - Matt Barrie: The awesome power and risk of Artificial Intelligence

In this summer special episode, Erik Townsend welcomes Freelancer.com CEO Matt Barrie to the show for an extra-long interview to discuss the macro impacts and knock-on effects of Artificial Intelligence.

Number 8 - It Was Never About Emissions – Doomberg

Carbon capture technologies are about to get the nuclear treatment.

https://schneiderwealth.ca/wp-content/uploads/2023/08/Doomberg-on-Carbon-Capture.docx

Number 9 - REVEALED: The One Thing Keeping US Cable TV in Business! - The Home Team

https://www.youtube.com/watch?v=Kf6ACaMHqJc

Yes, older folks are still watching TV and there are sports….but the big thing keeping cable is that Big Pharma represents 75% of the advertising based on numbers from just 2 months ago.

Only New Zealand the US are the countries that allow advertising. As Patrick Bet-David says, all the networks would be gone if this advertising was not allowed.

We hope you found the Top Ten interesting this week, and are looking forward to another selection of articles, stories, and commentary next week. If you know of anyone else who would be interested in receiving our weekly note, please let me know.

Schneider Wealth Management is a trade name of Aligned Capital Partners Inc. (ACPI)* – ACPI is regulated by the Investment Industry Regulatory Organization of Canada (www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (www.cipf.ca). David Schneider is registered to advise in securities and/or mutual funds to clients residing in British Columbia, Alberta, Manitoba and Ontario. This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author(s) and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Schneider Wealth Management. Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service. Past performance is not indicative of future performance, future returns are not guaranteed, and a loss of principal may occur. Content may not be reproduced or copied by any means without the prior consent of the author and ACPI.